Investors are the Catalyst

By Eric L. Dobson

After 15 years in the entrepreneurship/angel investing world, here is what I have learned. Investors are the catalyst for change. Many of you won’t like what I am about to say. If you want to change your community’s startup ecosystem, you have to create investors first. Creating entrepreneurs without investors to support them is a fool’s errand.

I am a recovering scientist turned into a recovering entrepreneur turned into an active angel investor. I spent the first decade of my professional life essentially as a data scientist. Then, I founded 4 companies raising over twelve million dollars in investor capital. Some of those companies were successful, and some were not. I have assisted in the founding and launch of six more companies. Some of them were successful, and some were not. And, now I have lead investments in 25 early stage private equity companies. Most of them are still going strong. I have lived on both sides of the table as an entrepreneur and an investor. And, I have seen a large number of success and failure modes from the inside. I say this for one reason, to establish that I have put in my requisite 10,000 Gladwell hours on both sides of the industry built on a data scientist’s evidence-based discipline. To shameless steal a term from sports, I am a student of the game. And, it is one I love. Returns are the measuring stick for success in this industry, but I get out of bed in the morning for a simple reason. There is no greater thrill than helping lift an outstanding team with an innovative idea into a successful company. Helping others reach their potential and being able to share in their success (strategically and emotionally) is its own reward. And, it can be very lucrative if you do it correctly.

I now have 15 years in the angel industry. For the first 11 years of that period I was an entrepreneur. For the last 4 years, I have been an investor. I spent the first two years spending 90% of my time with companies seeking capital believing that if I found the most compelling companies, I would attract the best investors. I was wrong. Creating great opportunities for angel investors does not generate excitement at the level I expected (creating exits does, but that can take years to precipitate). I now spend 90% of my time working with and creating more and better investors because I realized that without the investor, the industry collapses. I work to create high performing angel groups because they are the catalyst for changing communities and our entire economic outlook. Simply stated, angel investors cultivate companies that create value, wealth, and jobs.

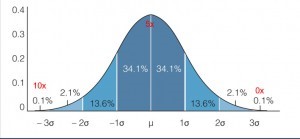

Startups require investment. There is no way around that. Traditional economic development thinking, or a “Moneyball” approach, is the more at-bats with the right player the higher the success rate. Applied to entrepreneurship, this translates to the more companies that are founded, the more likely you are to create a success/exit. This is what we assume:

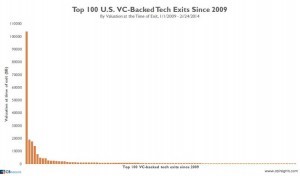

But, this is reality:

(Courtesy of CB Insights, The Venture Capital Power Law - Analyzing the Largest 100 US VC-Backed Tech Exits, March 7, 2014)

So, communities create incubators, accelerators, and coworking spaces to drive at-bats. Why do they do this? Simple. They focus on starting companies in the hopes of attracting investors to grow the ecosystem. And, it is politically incorrect to talk about making people of means more successful. Capitalism seems to be a dirty word these days, which makes me sick to my stomach. If my thesis is correct, we have a mismatch in what we want, our reasons for our actions, and clarity of required actions. One thing is sure. Without capital, startups that form will die-on-the-vine for lack of resources or leave the area to find the resources they need.

Obviously, my thesis is not 100% correct or we would not see bootstrapped companies arise, be successful, and grow to exit, which clearly happens. Some startups will never seek capital because they are funded by the founders. Some will find grants. But, these companies are rare and I believe these are the exceptions that prove the rule. And, these companies would be successful anywhere with or without the community’s assistance.

So, let’s dig deeper. The vast majority of startups seek capital. They do so because they have to do so. No rational human would go through the rigors (there are many better words to use, but this is a family oriented blog) of raising capital if it was not absolutely necessary. Regardless of what you are selling, it takes resources (time and/or money) to perfect the product/software/service, market and sell it, and deliver it to the client. The number one stated reason (although I am not convinced this is the true, underlying cause) for companies failing is “undercapitalization.” So, the concept that creating more underfunded or unfunded startups in order to improve your community’s economic development program is, at best, contradictory.

Investors are the catalyst for change, even though they don’t realize it and probably don’t want the credit. Capital creation is a bond with your community. It means the leaders have stated they will support great teams with great ideas. It means that money will be invested for initiative, innovation, and execution. It means taking a risk will be rewarded. It results in the creation of new enterprises for the community. It means a community can improve its hit rate if there are disciplined investors. It means wealth will be created for both entrepreneurs and investors. And, these will be the ambassadors that bring others into the mix in a self-sustaining fashion.

Therefore, if you want to change your community, you need to focus on creating more and better investors. Successful investors follow a disciplined investing strategy. If they are successful, others will follow them. If companies are getting funded, entrepreneurs will come calling. Investors are the “bell cows” (as we say in Southern parlance) that draw the community together. Angel investor should be a term of pride and respect. They are the key to creating the community you deserve!

Copyright Eric L. Dobson, 2016

@edobson865 | @angelcapitalgr | www.linkedin.com/in/ericdobsontn | www.facebook/angelcapitalgroup